The Dividend Note - emerging value from these FTSE 100 stocks? WTB, SN. (03/05/24)

Welcome back to The Dividend Note.

This week I'm looking at two companies I think have the potential to provide reliable dividend growth and could be reasonably valued.

Both are somewhat out of favour at the moment, but – in one case, at least – I think a buying opportunity could be emerging.

Companies covered

These notes contain a review of my thoughts on recent results from UK dividend shares that are of interest to me. In general, these are dividend shares that may appear in my screening results at some point.

Please note that my comments reflect my personal views and are not investment advice or recommendations. Please do your own research and seek professional advice if needed. Full disclaimer here.

- Whitbread (LON:WTB) - a solid set of results showing strong cash conversion and a well-supported 31% dividend increase. I have some reservations about increased leverage but am broadly positive on valuation and outlook.

- Smith & Nephew (LON:SN) - I feel like this should be the kind of business that is of interest to me, but I'm discouraged by heavily-adjusted profits, low margins and plenty of debt. Potentially cheap, but probably not something I'm interested in at the moment.

Whitbread (WTB)

"The Board is recommending a 26% increase in the final dividend per share"

Results for 52 weeks to 29 Feb 2024 / Mkt cap: £5.5bn

Current year forecast dividend yield: 3.3%

This week's full-year results from Premier Inn owner Whitbread revealed a 21% rise in pre-tax profit and a 26% increase in the final dividend.

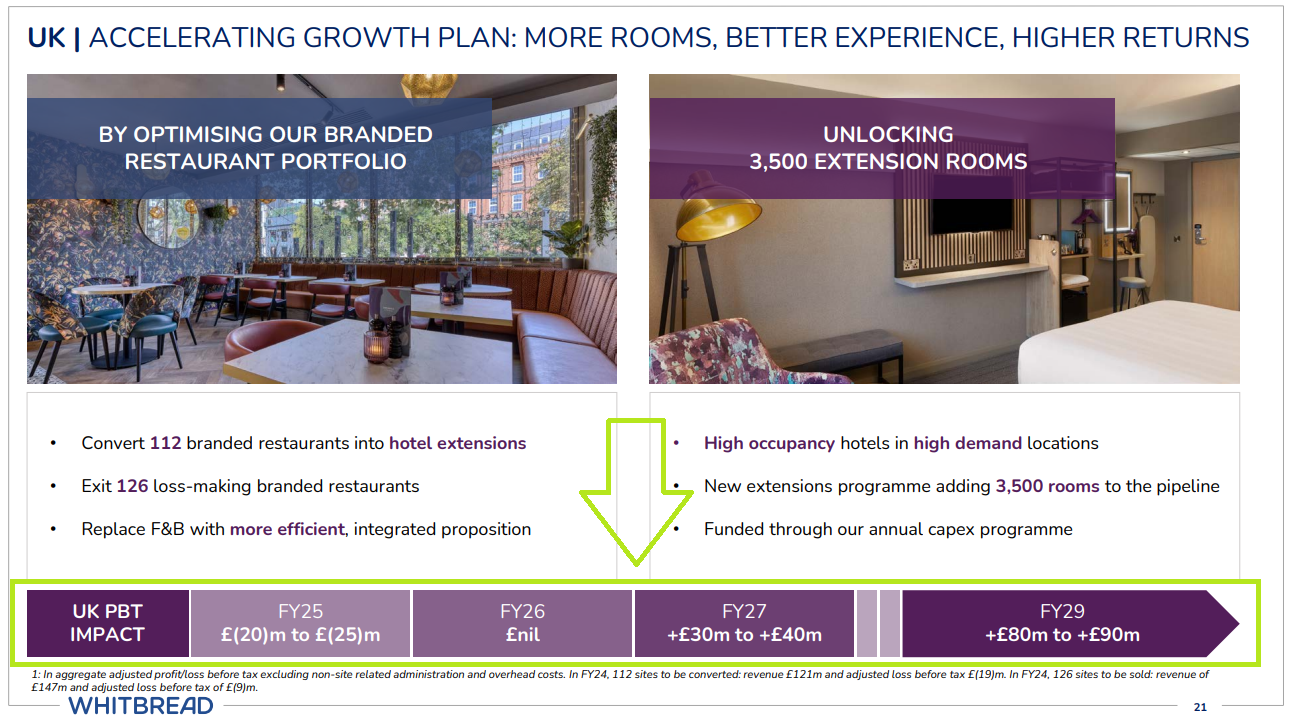

However, the outlook was dominated by plans to close 126 loss-making restaurants and convert a further 112 into hotel extensions. This is expected to lead to 1,500 job cuts.

These extensions form part of a £500m plan to create 3,500 additional rooms in existing hotels. This is in addition to Whitbread's committed UK pipeline of 7,000 rooms in new hotels.

Whitbread says it continues to see growth opportunities in the UK market. The company expects to increase room numbers from 85,000 to 97,000 by 2029, enroute to a "long-term potential" total of 125,000.

I last covered Whitbread in June 2023 and remain a fan of this business, both as an investor and a customer. The shares have drifted lower since last summer and I'm starting to see some value here. But this week's results suggest increased capex could drag on results before starting to deliver additional profits.

Let's take a look at the numbers.

FY24 results summary: headline performance over the last year looks quite strong.

Whitbread saw revenue rise by 13% to £2,960m, supporting a 21% increase in pre-tax profit to £452m.

Improved profitability saw the group's pre-tax margin rise to 15.3% (FY23: 14.3%). Pre-tax profits include the impact of IFRS 16 lease interest costs, so I think this is a more useful measure of profitability than the usual choice of operating margin.

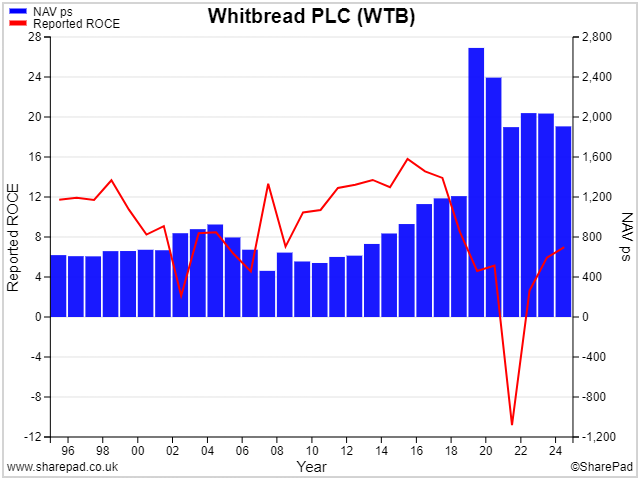

Return on capital employed (ROCE) was 6.7% last year according to my statutory calculation, with return on equity of 8.9%.

Whitbread's adjusted measure of ROCE was 13.1%, which was achieved using adjusted operating profit and an optimised (adjusted) measure of capital employed. These adjustments don't look too aggressive to me, but I prefer to take a holistic view that encompasses the whole balance sheet and is more easily comparable with other companies.

On this basis, Whitbread doesn't look like a high-return business, although it has certainly created plenty of shareholder value in the past. This was particularly true during the low-interest period that followed the financial crisis, when capital was cheap:

Earnings & dividend: reported earnings rose by 16% to 161p last year, supporting a 31% increase in the total dividend to 97p per share. That gives a 3.2% yield at the last-seen price of £30.

Balance sheet & cash flow: Whitbread says 52% of its property is freehold, with the remaining 48% leasehold. The balance sheet showed land and buildings worth £3.7bn at the end of FY24, supporting a net asset value of £3.5bn, or c.£19 per share.

However, NAV fell by £0.6bn last year due to an increase in leverage. Whitbread moved from a net cash position of £171m to a net debt of £298m last year (both figures exclude c.£4bn of lease liabilities).

In covenant terms, management says leverage rose to 2.9x EBITDAR last year (FY23: 2.6x), but remained below the 3.5x limit for an investment grade credit rating.

Last year's £469m increase in net indebtedness was driven by £591m spent on share buybacks. Personally, I would have preferred the company to maintain a net cash position rather than buyback shares.

With the stock trading c.50% above book value and generating a return on equity of less than 10%, I'm not sure how much value buybacks are creating.

CEO Dominic Paul's previous role was at Domino's UK – a business that's also fond of buybacks and which I feel uses more debt than necessary. I hope Paul isn't going to apply this philosophy too assiduously at Whitbread.

Fortunately, Whitbread's cash generation remained strong last year. My sums suggest FY24 free cash flow of £283m, giving 91% cash conversion from reported net profit of £312m.

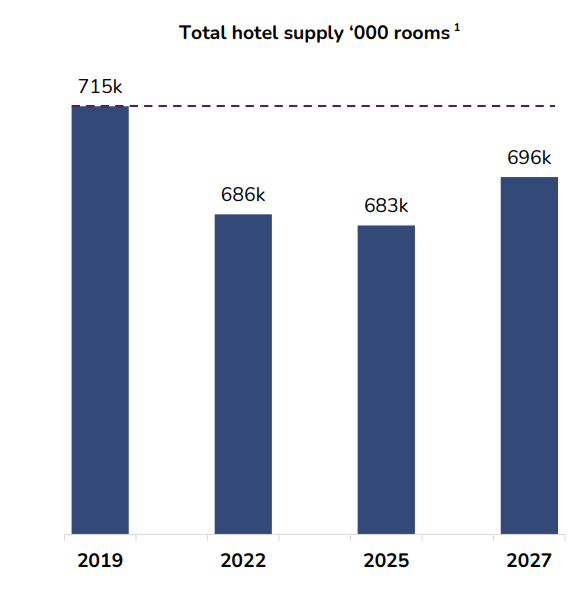

Trading commentary - UK: the pandemic has had a lasting impact on the UK hotel market. The total number of UK hotel rooms fell by 4% to 686k between 2019 and 2022.

Premier Inn says room supply is not expected to return to 2019 levels for "at least the next four years". The company sees this as an opportunity for Premier Inn to backfill the loss of (mostly) independent rooms which occurred during the pandemic:

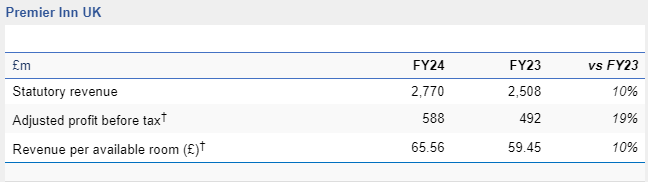

Trading performance from the existing UK Premier Inn estate was good last year, with revenue up 10% and adjusted pre-tax profit up by 19%.

The adjusted pre-tax margin of the UK business rose by 1.6% to 21.2%, while occupancy remained stable at 82.2% (FY23: 82.7%).

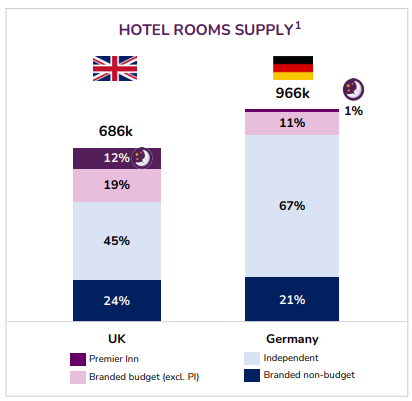

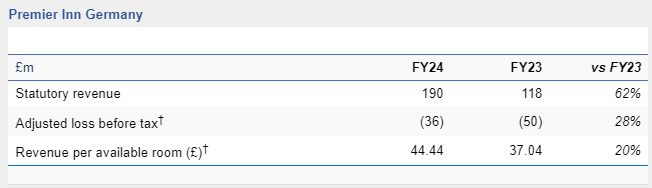

Trading commentary - Germany: Whitbread is aiming to repeat the UK success of the Premier Inn concept in Germany.

Germany's hotel market is 40% larger than in the UK, but Whitbread says it is highly fragmented with "no clear market leader" and an independent sector that's "in long-term decline".

Whitbread thinks the Premier Inn model will work well in Germany, with some localisation, and is rolling out hotels steadily. The company has committed £1.1bn of capital to Germany and believes this should generate "longer-term returns of 10%-14%".

Revenue from Premier Inn Germany rose by 62% to £190m last year and losses were reduced. Management expect this business to reach breakeven during the current year:

Outlook: guidance for the 2024/25 financial year suggests that UK inflation will ease and the German business will break even on a run-rate basis later this year.

Whitbread expects to open 750-1,250 rooms in the UK and c.400 rooms in Germany during FY25.

Capex of £550m-£600m should be partly offset by proceeds from property transactions of £175m-£225m. This is expected to includes sale and leasebacks, as well as disposals. I hope the balance sheet won't be hollowed out too much.

Broker consensus forecasts suggest adjusted earnings could rise by 9% to 225p per share this year, supporting a near-flat dividend of 97.7p per share. These estimates price the stock on 13.3 times earnings, with a prospective yield of 3.3%.

My view

Last year's results price Whitbread shares with a free cash flow yield of 5.1% and a dividend yield of 3.1%. This is cheaper than normal for this business, although this may partly be explained by the expected near-term drag on profits as the UK growth plan ramps up:

I have some reservations about the company's newfound enthusiasm for buybacks and would not want to see leverage rise too much further.

With Costa Coffee now gone, I think profitability is also likely to be capped by the relatively capital-intensive nature of the group's owned-and-operated business model.

Even so, I think Premier Inn is fundamentally an above-average quality business. On balance, I suspect that Whitbread shares are probably quite reasonably priced at current levels.

Although some patience may be needed, I think Whitbread would have to be unlucky or uncharacteristically inept to damage the UK Premier Inn business.

I think there's also a reasonable chance that the company will be able to achieve similar success in Germany, over time.

With the stock trading at c.£30, I might consider Whitbread shares as an income buy for my portfolio.

Smith & Nephew (SN)

"Full year 2024 guidance unchanged"

Q1 2024 trading update / Mkt cap: £8.6bn

Current year forecast dividend yield: 3.1%

I've covered a few pharmaceutical stocks recently (GSK, AZN, HIK) but have not looked at medical devices group Smith & Nephew before. This business can trace its roots back to 1856 and originally made its name with surgical dressings. It was also the investor of Elastoplast.

Smith & Nephew has expanded through acquisitions and today sells a range of joint replacement, sports medicine, and wound management products.

This group is a FTSE 100 firm and feels like it should be a high-margin, good quality business.

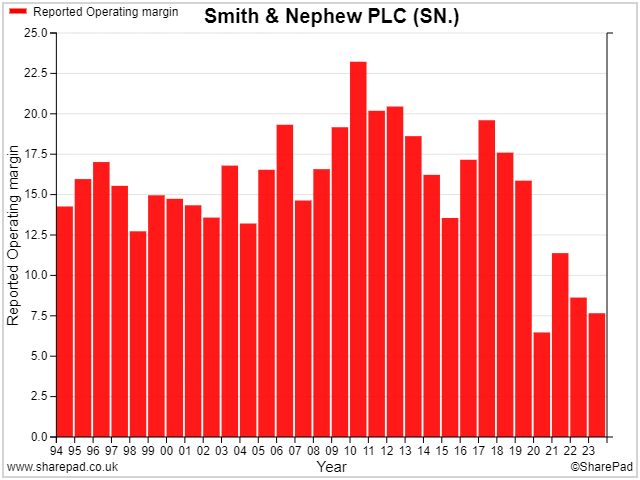

Unfortunately for shareholders, the reality has been different in recent years. Smith & Nephew's share price has fallen by 50% from the £20 high seen in 2019:

This decline has reflected the group's reported operating margin which has halved over this period and is now under 10%:

This decline has left the shares trading on a forward P/E of 13, with a 3.1% dividend yield.

If management can rebuild margins and deliver a return to consistent growth, I reckon a higher rating could be justified. Potentially, much higher.

I've been meaning to take a look at this business for a while to see if it could become the kind of good, cheap stock I like to buy. This week's first-quarter trading update provided a good opportunity, so I've noted down some thoughts below.

Q1 2024 trading summary: Smith & Nephew's progress during the first three months of 2024 appears to be mostly positive, if unspectacular:

- Q1 revenue up 2.2% to $1,386m, said to be in line with expected 2024 phasing

- Orthopaedics revenue +3.6% to $567m

- Sports Medicine & ENT +4.5% to $441m

- Advanced Wound Management -2.3% to $378m

One problem seems to be that the group's core US market is flat (or else S&N is losing share):

- US revenue: -0.6% to $733m (53% of group revenue)

The culprit seems to be "continued weakness" in US hip and knee implants. These accounted for 28% of total revenue in Q1, but this figure was only 1% higher than the same period last year.

Sales in other established markets rose by 4% to $420m, while emerging market sales rose by 8.5% to $233m.

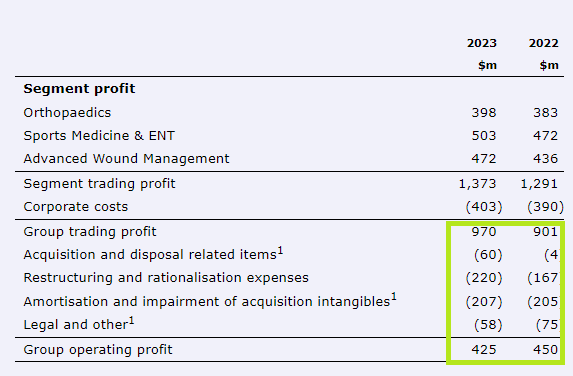

Profitability: I wonder if some parts of this business are more profitable than others. I've scrolled back to last year's result to try and find out.

Smith & Nephew prefers to use a heavily adjusted version of operating profit called trading profit. While I'm not a fan, it's all we have for the group's operating segments.

2023 segmental trading profits:

- Orthopaedics: $398m (17.9% margin)

- Sports Medicine & ENT: $503m (29.0% margin)

- Advanced Wound Management: $472m (29.4% margin)

The results show similar performance in 2022, so it seems that the orthopaedics business is dragging on group margins. The company says it has a 12-point plan to improve performance in orthopaedics and expects to benefit from improved product supply and commercial execution in the US market.

It's worth noting that other areas of orthopaedics appear to be performing better. The Q1 figures showed "Trauma & Extremeties" revenue up 7.3% to $146m. New robotics-based services used in joint reconstruction are also showing promising growth, with revenue up 17% to $27m.

Outlook: full-year guidance for 2024 was left unchanged, with management guiding for underlying revenue growth of 5%-6%, or 4.3%-5.3% at current exchange rates.

Trading profit margin is expected to be "at least 18.0% in 2024. For contrast, this heavily adjusted figure was 17.5% in 2023.

However, Smith & Nephew's reported operating margin was just 7.7% last year, highlighting the massive scale of adjustments used here. I am not a fan of such heavily adjusted measures:

In this case, I note that the company's return on equity was just 5% last year and that free cash flow conversion was also quite poor. In my view, the lower, reported operating margin is probably a more reasonable guide to shareholder returns at the moment.

However, broker forecasts are generally aligned with company-adjusted measures. In this case I can see that adjusted earnings are expected to rise by 18% to 98.2 cents per share this year.

A relatively modest dividend increase of 2.7% to 38.3 cents per share is expected, perhaps implying continued high capex and poor free cash flow conversion.

My view

I think Smith & Nephew is probably quite affordably priced at current levels. Only a modest improvement in margins and cash generation would be needed to support a re-rating, in my view.

However, net debt of $2.7bn seems a little high to me relative to last year's pre-tax profit of $290m. I'm also discouraged by the company's dependence on heavily-adjusted profit metrics.

If I was going to continue researching this, I'd probably take a look at some of the company's competitors to get a better understanding of Smith & Nephew's position in its key markets.

I would also want to look a little further back to understand why margins have collapsed since 2018.

I should stress that I have only taken a cursory look at this business and I may be missing something.

Aside from the real possibility of improved performance, I can also imagine that a larger trade buyer might be interested in acquiring this business at current levels in order to gain access to its market share and intellectual property.

I'll probably take another look at Smith & Nephew at some point. But I think there are probably more attractive options for me elsewhere right now.

As always, thanks for reading – and please feel free to share your thoughts in the comments below.

Roland Head

Disclosure: Roland owned GSK shares at the time of publication.

Disclaimer

This is a personal blog/newsletter and I am not a financial adviser. All content is provided for information and educational purposes only. Nothing I say should be interpreted as investing advice or recommendations.

You should carry out your own research and make your own investing decisions. Investors who are not able to do this should seek qualified financial advice. Reasonable efforts are made to ensure that information provided is correct at the time of publication, but no guarantee is implied or provided. Information can change at any time and past articles are not updated.

Member discussion